Finance plays a vital function in the fashionable economy, encompassing an array of functions that manage and allocate monetary sources. It serves since the backbone of economic development, facilitating transactions, investments, along with the stream of funds across industries and men and women. Knowledge the fundamentals of finance is critical for people, corporations, and governments alike for making educated conclusions and manage means effectively.

At its Main, finance consists of the management of money and belongings. This involves routines including budgeting, investing, lending, borrowing, and danger administration. The ideas of finance apply universally, regardless of whether in individual economical setting up or while in the intricate operations of world monetary marketplaces.

One of many key ideas in finance is the time worth of money. This theory states that a sum of cash nowadays is worth in excess of the identical sum Down the road as a result of its potential earning capability. This sorts the basis for assessing financial investment options and examining the expense of capital. By comprehension some time value of funds, persons and organizations could make audio money conclusions that maximize returns and decrease pitfalls.

Investing is yet another critical aspect of finance, involving the allocation of funds into assets With all the expectation of creating favorable returns after some time. The intention of investing may differ based on the investor's danger tolerance, economic ambitions, and time horizon. Widespread financial commitment motor vehicles involve shares, bonds, mutual cash, real-estate, and commodities. Every single asset class carries its personal danger-return profile, requiring buyers to diversify their portfolios to unfold threat and optimize returns.

Financial marketplaces Engage in a pivotal part in facilitating the getting and promoting of monetary property. These markets involve inventory exchanges, bond markets, commodities marketplaces, and derivatives markets. Economical property traded in these markets empower firms to raise funds, investors to diversify their portfolios, and governments to finance general public tasks. The performance and transparency of economic marketplaces are essential for fostering believe in and liquidity, making sure that capital flows to its most efficient makes use of.

Hazard management is integral to finance, as all economical choices contain some degree of uncertainty. Productive danger administration strategies goal to detect, assess, and mitigate challenges that may affect financial outcomes. Approaches such as diversification, hedging, and insurance policies help folks and businesses secure towards likely losses and stabilize economical overall performance after a while.

Company finance concentrates on the economical administration of companies and corporations. It encompasses actions including money budgeting, fiscal setting up, and strategic economical decision-creating. Corporate finance professionals analyze monetary statements, Assess investment decision options, and decide optimum capital structures To optimize shareholder price. The purpose is usually to allocate assets successfully, regulate hard cash flows proficiently, and realize sustainable progress.

Private finance is Similarly significant, as men and women navigate their economic lives by budgeting, conserving, investing, and retirement preparing. Own fiscal organizing involves placing economical aims, managing personal debt, and preparing for unpredicted fees. It emphasizes the necessity of financial literacy and accountable dollars management to obtain lengthy-expression economic security and independence.

Economical establishments Enjoy a important part from the economic climate by offering essential fiscal products and services to persons, businesses, and governments. These institutions https://mikeallsted.com/ include things like banking companies, credit history unions, insurance policies businesses, and investment firms. Banks serve as intermediaries that settle for deposits from savers and supply loans to borrowers, thus facilitating economic activity and liquidity in money marketplaces. Insurance policies companies present protection from economical losses as a result of various insurance policies solutions, even though investment corporations manage and commit resources on behalf of purchasers to generate returns.

The worldwide monetary method connects financial marketplaces and institutions globally, enabling the move of capital throughout borders. International finance will involve the management of financial transactions in between nations, such as international exchange markets, Global trade funding, and cross-border investments. It performs an important part in promoting financial progress, facilitating trade, and fostering Global cooperation.

Money regulation and governance are important to preserve the stability and integrity of financial devices. Governments and regulatory bodies build rules, restrictions, and policies to supervise fiscal markets, safeguard buyers, and forestall misconduct. Regulatory frameworks goal to market transparency, mitigate systemic hazards, and ensure reasonable and effective current market practices. Compliance with regulatory prerequisites is essential for preserving public believe in and self-assurance within the economic technique.

Technological progress have remodeled the landscape of finance by way of improvements including fintech (fiscal technological know-how). Fintech companies leverage technology to deliver money products and services far more successfully, strengthen accessibility, and increase shopper knowledge. Examples consist of cellular banking applications, electronic payment platforms, robo-advisors for automatic financial commitment management, and blockchain engineering for protected and transparent transactions. These improvements have democratized usage of monetary solutions, expanded economical inclusion, and accelerated the rate of economic innovation globally.

Moral concerns are paramount in finance, as economical decisions effect stakeholders at numerous degrees. Ethical finance promotes accountable methods, reasonable treatment method of shoppers, and sustainability in financial investment choices. Environmental, social, and governance (ESG) requirements are more and more built-in into expenditure approaches to align fiscal goals with broader societal and environmental goals. Buyers, businesses, and policymakers are recognizing the significance of moral finance in advertising and marketing lengthy-term worth generation and addressing world difficulties.

Financial instruction and literacy are essential for empowering men and women to generate knowledgeable financial choices. By understanding financial ideas, threats, and prospects, folks can correctly control their funds, plan for the long run, and reach economic plans. Economical literacy packages intention to further improve financial knowledge and expertise across diverse demographics, marketing economic security and prosperity.

In conclusion, finance is often a dynamic area that underpins financial activity and drives expansion across sectors and geographies. From own money planning to international economic marketplaces, the rules of finance tutorial conclusions that allocate assets, handle threats, and produce benefit. By being familiar with the fundamentals of finance and embracing ethical practices, individuals, organizations, and societies can navigate economic worries, capitalize on chances, and produce a prosperous foreseeable future.

Tia Carrere Then & Now!

Tia Carrere Then & Now! Charlie Korsmo Then & Now!

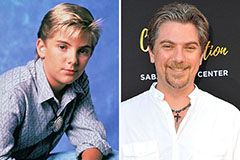

Charlie Korsmo Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now!